Even though Bangladesh is an agricultural country, its agricultural product exports grew at a slower pace compared to other goods over the past decade due to a lack of policy support, high costs and the absence of good agricultural practices.

The country’s annual export earnings soared 114 percent to $50 billion in fiscal year 2022-23 in around a decade.

For all latest news, follow The Daily Star’s Google News channel.

And while data for the whole of fiscal year 2023-24 is not yet available, it stood at $40 billion in the July-May period, according to data of the Bangladesh Bank.

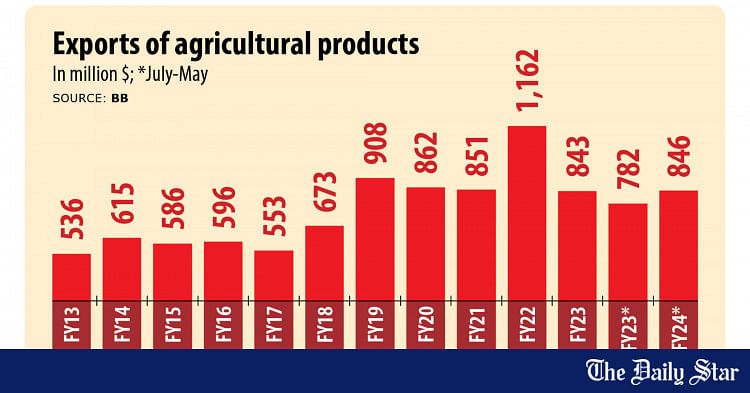

The country’s export of agricultural products was worth $536 million in fiscal year 2012-13 and it rose by 57 percent to $843 million by the end of fiscal year 2022-23.

In the 11 months of the last fiscal year, it was $846 million, the data showed.

And while there are several barriers to exporting agricultural products, the main one is a lack of policy support, said Md Iqtadul Hoque, general secretary of Bangladesh Agro-Processors’ Association (BAPA).

For instance, aromatic rice exports were banned over apprehensions that it could put the country’s food security at risk. “But this type of rice is not an essential food so it is not linked with food security,” he added.

According to the Department of Agricultural Extension (DAE), Bangladesh annually produces up to 19 lakh tonnes of aromatic rice, of which it exports only about 10,000 tonnes.

As such, the government has the scope to earn a huge amount of foreign currency by allowing the export of aromatic rice, said Hoque.

There are many other examples of how policy support is lacking, including a reduction of cash incentives from 20 percent to 15 percent from fiscal year 2024-25, he said.

The high cost of raw materials is another reason that local exporters are lagging in international competition, he said, adding that the price of sugar has more than doubled in Bangladesh compared to India and Pakistan.

The price of wheat is also higher in the country, and sugar and wheat are two major ingredients of juice and snack items. “So how will we compete with others?” he asked.

Container freight costs also rose 4 to 5 times here. Besides, food producers need to import specialised packaging and pay a high duty to this end, which pushes up their input cost, said Hoque.

At present, there are 486 manufacturers of processed agricultural products, of which 241 are exporters while the rest cater to the domestic market.

Bangladesh exports cereal grains, tea, vegetables, tobacco, flowers, fruits, spices, dry food and other processed agricultural products to more than 145 countries.

Although the export earnings of the agricultural sector are not soaring, it is helping to ensure food security while also saving the country’s foreign currency by providing import substitutes, Hoque added.

By fiscal year 2022-23, Bangladesh’s food crop production had increased by around 38 percent to 467 lakh tonnes, as per data of the finance ministry.

Eleash Mridha, managing director of PRAN Group, said the export of agricultural products dropped in the last two years mainly due to the ban on exporting aromatic rice.

He also blamed high prices of sugar and flour and the rise in freight costs, saying cargo freight costs have not increased over the last couple of years in India and Thailand but it did rise in Bangladesh.

“So, we lag behind in competition,” he added.

The Association of Southeast Asian Nations (ASEAN) is a good market for Bangladesh and so, the government could sign a free trade agreement with the ASEAN member countries in order to grab the market, he said.

Bangladesh’s agro-processing sector has huge potential as most of the raw materials are locally produced, Mridha said, adding that the demand for their products is also high abroad.

As a result of the revolution in agricultural production, Bangladesh ranks third globally in the production of rice, vegetables, and onions while it is second in jute production, fourth in tea production and seventh in potato and mango cultivation.

Crop production in the country has risen in recent years thanks to farm mechanisation.

For example, around 6 percent of the agricultural land in Barishal has been lost due to urbanisation and other causes between 2014 and 2019. However, rice production in the region has not decreased and instead rose by 1.5 times owing to modern cultivation techniques.

In this situation, the country needs to focus on two things before putting in the effort on exports and securing a good position in global markets, said Md Nazim Uddin, senior scientific officer of Bangladesh Agricultural Research Institute (BARI).

The first is to implement good agricultural practices and the second is to ensure the testing of products in laboratories accredited by the International Organization for Standardization (ISO), he said.

Good agricultural practices encourage moderate use of pesticides, organic and chemical fertilisers, and environment-friendly management of resources, he said.

In implementing these practices, it is important that uniform and correct procedures are adopted all throughout the way. It would ensure consumers’ confidence as foreign buyers seek assurance of quality food, said Nazim Uddin.

Apart from Western countries, the Middle East has a huge demand for Bangladeshi products and other Asian countries are also exporting to this market comparatively easily, he said.

Sending agricultural products to the Middle East requires proper certification for ensuring food safety. Sometimes, ultrasonic washing and packaging can improve the quality, he added.

Nazim Uddin also said freight costs and a shortage of space for air cargoare major reasons for the low export of agricultural products.

“There is a huge potential for agricultural exports as the international market is huge,” he added.

Data of Bangladesh Investment Development Authority shows that the international agriculture market is projected to reach $19,000 billion with a compound annual growth rate of 9.1 percent by 2027.

Bangladesh’s total market size for agricultural products was $47.54 billion till 2022. So, there is a huge potential to grow the industry to capture the market. In this situation, the focus should be on the agro-processing industry, Hoque said.

The Bangladesh Institute of Development Studies, a state-run research firm, also identified in a research paper that policy barriers have a major impact on the export process of fruits and vegetables.

Export expansion and demand from supermarkets is constrained by poor quality of produce and imposition of different sanitary and phytosanitary criteria by importing countries, it said while adding that the high cost of airfreight is another big barrier.

Although the industrial and service sectors grew fast over the past decade, even contributing to export earnings and GDP, employment in the agricultural sector remains the major contributor. This indicates that the agricultural sector can ensure a higher number of jobs.

In fiscal year 2016-17, jobs in the agricultural sector accounted for 41 percent of the total labour force while it rose to 45 percent in 2022.

Interestingly, more women are joining the agriculture sector in Bangladesh as their job opportunities in industries, especially garment factories, have stagnated while men are switching to non-farm sectors.

Of the 31.98 million people employed in agriculture, 18.43 million are female, the data showed.

BAPA’s Hoque recommended that they be provided bonded warehouse facility and tax rebates so that they could compete with international competitors.

To increase the contribution of the agricultural sector, he suggested that banks should come forward to provide more loans and the government should promote and facilitate farm mechanisation.

BARI’s Uddin recommended focusing on Middle Eastern and Asian countries and following good agricultural practices targeting the Western countries.

He also suggested that contract farming by corporates could be a good way of sending products abroad as they can properly meet the preconditions set by the destination countries.

PRAN’s Mridha recommended reducing the duty on sugar and flour used by export-based agro-processing industries.

Images are for reference only.Images and contents gathered automatic from google or 3rd party sources.All rights on the images and contents are with their original owners.

Comments are closed.